Your Read is on the Way

Every Story Matters

Every Story Matters

The Hydropower Boom in Africa: A Green Energy Revolution Africa is tapping into its immense hydropower potential, ushering in an era of renewable energy. With monumental projects like Ethiopia’s Grand Ethiopian Renaissance Dam (GERD) and the Inga Dams in the Democratic Republic of Congo, the continent is gearing up to address its energy demands sustainably while driving economic growth.

Northern Kenya is a region rich in resources, cultural diversity, and strategic trade potential, yet it remains underutilized in the national development agenda.

Can AI Help cure HIV AIDS in 2025

Why Ruiru is Almost Dominating Thika in 2025

Mathare Exposed! Discover Mathare-Nairobi through an immersive ground and aerial Tour- HD

Bullet Bras Evolution || Where did Bullet Bras go to?

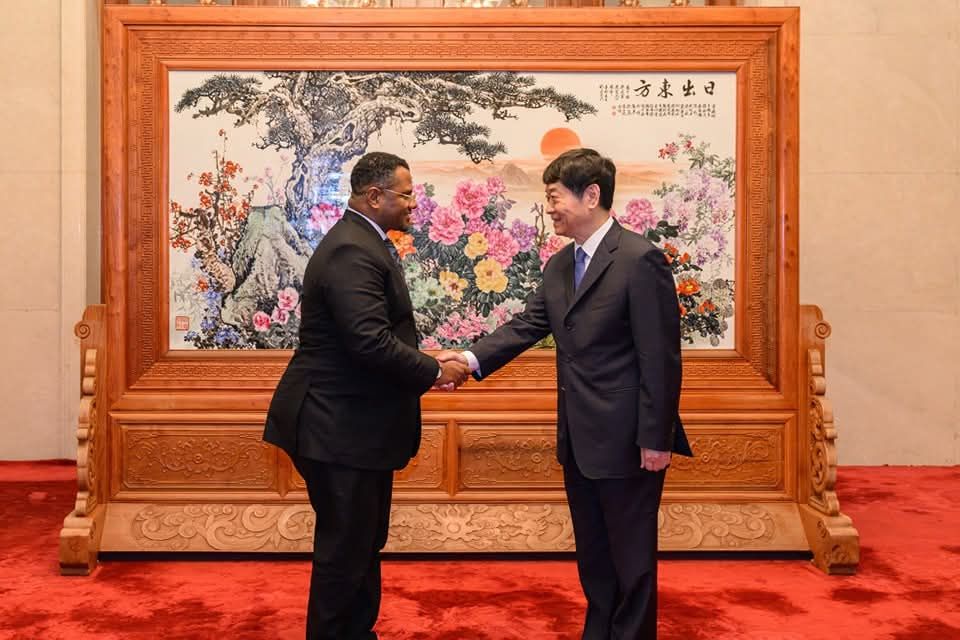

In an era where development diplomacy often unfolds in glittering summits and formal press briefings, the recent meeting between United Democratic Alliance (UDA) Secretary-General Hassan Omar and a Chinese developers’ delegation took a markedly different tone. Held at the UDA party headquarters in Nairobi—not a government ministry—the setting itself hinted at a less institutional, more political agenda.

The Chinese group, comprised of top-tier officials from Fujian Construction Investment Group and China Wu Yi, represents a significant extension of China’s soft power reach in East Africa. While the official press line described the meeting as part of ongoing efforts to “deepen development partnerships,” sources suggest the interaction was anything but routine. Analysts say it reflects a strategic pivot—where Kenya’s ruling party seeks to secure international capital and influence not just for government projects, but for party-led initiatives designed to extend political and economic control on the domestic front.

The Chinese delegation, led by Deputy General Manager Chen Zhita and flanked by a senior coterie of business development and planning executives, didn’t come bearing symbolic gifts or goodwill gestures. Their arrival followed closely on the heels of Omar’s discreet multi-city visit to China, a trip that bypassed media fanfare but included high-level talks in Beijing and other industrial power hubs. Behind closed doors, Omar and his team were reportedly exploring investment frameworks that could fast-track projects in transport, energy, housing, and urban planning—sectors where Chinese companies have both global dominance and a deep understanding of African market dynamics.

These meetings are rarely casual; they’re about testing alignment, exchanging non-public offers, and forging “understandings” that don’t require immediate public ratification. By holding the return meeting at party HQ, Omar signaled the UDA’s intention to be more than just a beneficiary of Chinese investment—it wants to be a gatekeeper.

Although partnerships between African governments and Chinese developers are common, the increasing trend of direct political party engagement is raising eyebrows. It suggests a shift away from state-to-state diplomacy toward party-to-party collaboration, where deals are shaped not solely by public policy but by ideological and strategic alignment. Fujian Construction Investment Group, backed by provincial Chinese authority, has been instrumental in building major highways, housing estates, and public works across Africa.

However, their model often includes controversial clauses—long lease periods, exclusive operation rights, and heavy reliance on Chinese labor and materials. Kenya’s ruling party may benefit in the short term through rapid infrastructure delivery and symbolic wins ahead of election cycles, but the long-term implications may include growing dependency, reduced local agency, and economic structures subtly shaped to suit Chinese strategic interests rather than purely Kenyan developmental needs. The line between investment and influence becomes thinner with every handshake behind a closed door.

The backdrop to this party-level diplomacy is President William Ruto’s recent high-profile state visit to China. That trip made headlines for discussions on debt restructuring, trade balance realignment, and expanded export opportunities for Kenyan goods. Yet, the nearly simultaneous UDA-Chinese developer meeting hints at a parallel diplomatic strategy.

While the president courts state-level benefits, the ruling party appears to be crafting a supplementary track—more agile, less scrutinized, and deeply embedded in political rather than governmental structures. This twin-track approach could give the party more control over how foreign investment flows are managed, potentially allowing them to tie development outcomes more directly to political branding and loyalty-building in key regions. However, it also exposes Kenya to a complex web of international interests, where the lines between cooperation and coercion may blur over time.

Kenya stands at a development crossroads, grappling with high external debt, swelling urban populations, and a restless youth demographic in need of jobs and housing. On paper, partnerships with well-resourced foreign developers promise fast results—shiny new roads, bustling industrial parks, and modernized cities. But development is never neutral.

The real cost of this infrastructure boom may be hidden in legal fine print and political dependencies. If UDA succeeds in tying China’s muscle to its local agendas, it could gain a formidable edge in upcoming political contests. Yet, such a strategy could backfire if public perception tilts toward resentment over foreign influence or if local businesses feel increasingly sidelined. As these deals remain tucked behind party doors, the Kenyan public is left with limited visibility into decisions that will shape their landscape, their economy, and their sovereignty for generations to come.

0 comments