Your Read is on the Way

Every Story Matters

Every Story Matters

The Hydropower Boom in Africa: A Green Energy Revolution Africa is tapping into its immense hydropower potential, ushering in an era of renewable energy. With monumental projects like Ethiopia’s Grand Ethiopian Renaissance Dam (GERD) and the Inga Dams in the Democratic Republic of Congo, the continent is gearing up to address its energy demands sustainably while driving economic growth.

Northern Kenya is a region rich in resources, cultural diversity, and strategic trade potential, yet it remains underutilized in the national development agenda.

Can AI Help cure HIV AIDS in 2025

Why Ruiru is Almost Dominating Thika in 2025

Mathare Exposed! Discover Mathare-Nairobi through an immersive ground and aerial Tour- HD

Bullet Bras Evolution || Where did Bullet Bras go to?

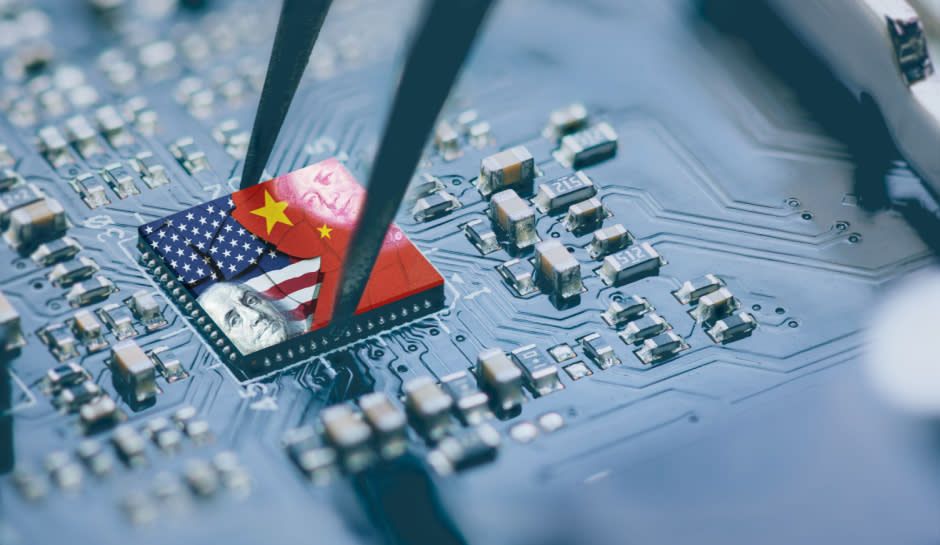

In a move that has sent ripples across global markets, US President Donald Trump has unveiled the "America First Investment Policy," a bold initiative aimed at restricting Chinese investments in key American industries. This sweeping policy underscores Washington’s growing concerns over economic security, national competitiveness, and the influence of Chinese capital in strategic sectors.

At the heart of this policy is a clear objective: to curb Chinese investments in technology, critical infrastructure, healthcare, agriculture, energy, and raw materials while simultaneously discouraging US investments in China’s military-industrial complex. The Trump administration has signaled that it will use "all necessary legal instruments" to enforce these restrictions, a declaration that has sent shockwaves through international investment circles.

One of the most contentious aspects of the policy is the US government's intent to review and potentially terminate the 1984 tax treaty with China. This agreement, which has played a significant role in facilitating cross-border trade and investment for decades, is now seen by the Trump administration as a mechanism that has accelerated China's economic rise at the expense of American industry. Critics warn that dismantling this treaty could disrupt long-standing business ties, further complicating an already fraught economic relationship.

A major point of focus in this policy is emerging technologies, particularly semiconductors, artificial intelligence, and biotechnology. The US is determined to prevent China from acquiring or investing in these cutting-edge innovations, arguing that they are critical to national security. This shift follows a broader trend of tech-related trade restrictions, including previous bans on Chinese firms like Huawei and restrictions on the export of advanced microchips.

Washington’s position is clear: economic security is national security. By tightening the reins on Chinese investments, the US aims to safeguard its technological edge and protect key industries from foreign influence. However, this aggressive stance raises significant concerns about retaliatory actions from Beijing, which may impose its own restrictions on American companies operating in China.

The policy also casts uncertainty over Hong Kong and Macau, two regions that have long served as financial bridges between China and the West. It remains unclear whether the US will extend investment restrictions to these financial hubs, but any move in that direction could further disrupt global capital flows and unsettle multinational corporations with business interests in these regions.

The timing of this initiative is particularly significant, given the ongoing US-China trade war and escalating diplomatic tensions. In recent years, both nations have exchanged tariffs, sanctions, and technological bans, each move adding fuel to an already volatile relationship. With this new policy, the Trump administration is taking the conflict beyond trade and into the realm of investment and economic decoupling.

Economists and political analysts remain divided on the long-term impact of these measures. Some argue that the policy will safeguard American industries and prevent China from leveraging US capital to advance its strategic goals. Others warn that it could backfire by stifling global investment, reducing economic cooperation, and accelerating the fragmentation of international trade networks.

As the world watches this economic battle unfold, one pressing question lingers—what's next for US-China relations? Will this policy mark the beginning of a new era of protectionism, or will it simply escalate existing hostilities? One thing is certain: the "America First Investment Policy" is a game-changer, and its consequences will shape the future of global trade for years to come.

0 comments